I’m not going to lie 2014 has been a bit of a tight year for us. Having a baby changes so much!

We’ve gone from having two decent wages and a reasonable disposable income each month to managing on hubbys wage alone. We’ve dropped around £2,000 a month!

Whilst it may have been a struggle, we’ve managed. I’m quite organised when it comes to our finances, I’m not quite a spreadsheet queen but I keep a record of our incoming and outgoings and dates and rough costs of our monthly bills written down in my ‘money book’. That way I have an idea of what money we have left at the end of the month, which is particularly helpful during the festive period.

When I was younger I accumulated a lot of debt. I had no idea about money and my priorities were nights out and nice clothes. I’d think nothing of going to Vivienne Westwood and putting £400 on one of my credit cards for a night out.

Madness.

I tried to live a champagne lifestyle on a lemonade wage! Thankfully, I learnt from my mistakes, with the help of a wonderful family and a lot of hard work I paid off every penny of debt I owed and started afresh, luckily with no negative affect on my credit rating.

Just because our circumstances have changed this year doesn’t mean our bills have gone anywhere. We haven’t been able to hide from them or pretend they don’t exist.

When our bills arrive,they live safely next to the laptop until they’re paid. Then I shred them and they’re forgotten about until the next month.

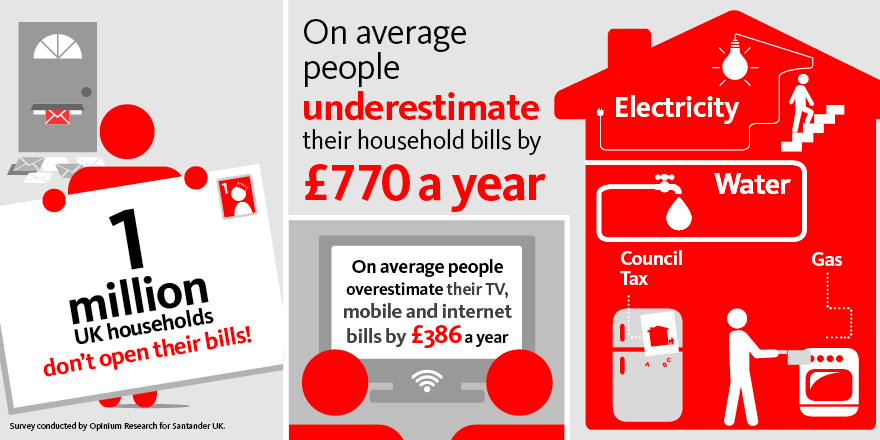

Rather scarily a survey conducted by Santander has shown that 26 per cent of households don’t read their utility bills properly and over a million households don’t open their bills at all!

I have a few tips of my own for staying on track with your money.

- Check you bank statement regularly. Make sure all direct debits are correct and up to date.

- Shop around for the best deal on your current account. Santander 123 account currently offers its customers cash back if they pay their household bills using the account.

- Keep a list or spreadsheet for all your incoming and outgoings

- Save! Try to put a little cash away each month, no matter how small it may be, it adds up and makes Christmas expenses more manageable.

- Try and pay off more than the minimum payments on any debt you have, making only minimum payments will mean it takes years to pay off your debt.

- Keep your statements paper. I find it much easier to manage my finances if I get my statement delivered rather than looking at it online.